First extensive study on Social Investment in Africa reveals financial trends and gaps

The African Venture Philanthropy Alliance (AVPA) launched ‘The Landscape for Social Investments in Africa’ high-level inaugural report on the state of social investment financing in Africa.

The report is the first of several concerted efforts aimed at addressing information gaps on social investments in areas such as Philanthropy, Impact Investing, Private Capital deployment and Corporate Sustainability Programmes across sub-Saharan Africa.

AVPA is a unique Pan-African network established in 2018 for social investors, headquartered in Nairobi with offices in Johannesburg and Lagos, with a mission to drive a transformative social investing agenda and build vibrant, influential community across Africa.

Their work is aligned with thriving sister networks in Europe (EVPA), South America (Latimpacto), and Asia (AVPN) to form a dynamic global force for social impact.

AVPA facilitates the flow of human, intellectual and financial capital, not only within Africa but also across countries involved with its partner organisations globally.

“Africa needs an estimated $500 billion - $1.2 trillion annually between now and 2030 to meet its financing gap for delivering on the United Nations Sustainable Development Goals targets.

With traditional sources of social investment like aid and government funding unlikely to fill this gap. Therefore, we need to turn to the global financial and capital markets for the requisite investments, “ says Dr. Frank Aswani, CEO of AVPA.

“This demands a good understanding of the social investment landscape on the continent and increasing collaboration amongst social investors by breaking down existing silos between providers of grants, debt and equity.

We are taking the first step in this direction with this study. It provides a baseline against which we can track future progress and key trends that will influence the increased flow of capital into social investments in Africa while working collaboratively to identify programmatic interventions for creating increased social impact.” adds Aswani in regards of carrying out this broad research.

The report presents findings of an eight-month study across 18 African countries - six each in West, East, and Southern Africa.

The study was commissioned by AVPA with support from the United States African Development Foundation (USADF), Social Capital Foundation, The Rockefeller Foundation, and an anonymous donor.

"The US African Development Foundation (USADF) supported AVPA to carry out a landscape study to understand better social investment across East, West and Southern Africa.

The findings will help drive strategies and plans for future investors, donors, foundations, and public sector financiers.

We are constantly looking for ways to partner with corporations and governments that are interested in the business growth of Africa." C.D. Glin, President and CEO, US African Development Foundation

AVPA conducted the study in partnership with Intellecap, the advisory arm of The Aavishkaar Group, which works to build businesses that can benefit the underserved segments across Asia and Africa. It mapped providers of social capital - financial, human and intellectual, their investment strategies, and opportunities for collaboration amongst the various investors.

The findings highlight, among other things, what is currently happening, who are the key players, what are their current approaches to investing, what challenges they are facing, and the opportunities they are seeing. It also identifies additional areas of future research while making recommendations of opportunities to create a more vital ecosystem for increased capital flow and social impact on the continent.

Many social investors in sub-Saharan Africa operate in silos, necessitating strategic interventions to bridge gaps across the different types of capital and investment strategies.

Key findings of the report:

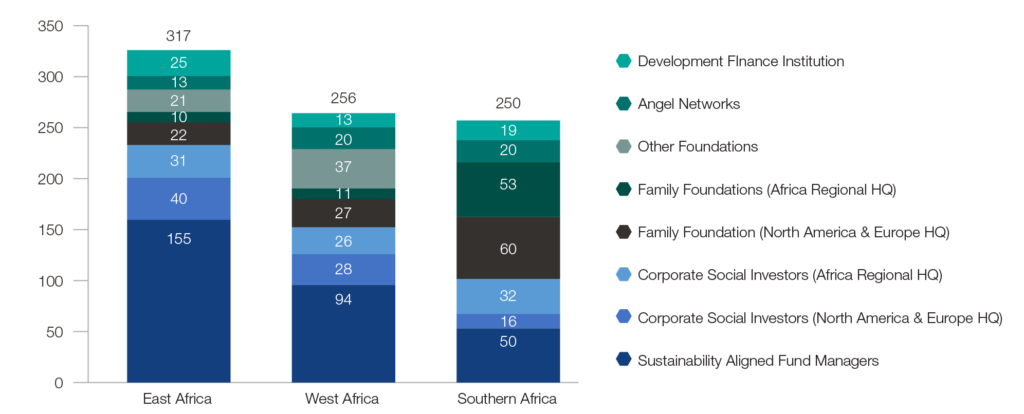

- Over 820 social investors are operating in the sub-Saharan African (SSA) region; 39% in East Africa, 31% in West Africa and 30% in Southern Africa.

- The majority of social investment capital deployed across the regions continues to come from international sources with a growing number of active regionally-based social investors.

- Donors, development finance institutions, and sustainability aligned fund managers are the largest providers of social capital across the SSA regions, deploying billions of dollars annually, mainly through long term projects.

- Corporates and corporate foundations are emerging as strong drivers of regional social investment ecosystems.

- While Southern Africa has the highest number of regional-based family foundations, a high level of activity was also recorded for regional family foundations in West Africa who are relatively public with information on their giving and the causes they support.

- Regional Corporate Social Investors (CSIs) across sub-Saharan Africa largely support basic services (health and education) provision, while North American CSIs mostly focus on economic empowerment and entrepreneurship initiatives.

- Development finance institutions and sustainability aligned fund managers investments across the regions are highly concentrated by geography and sector, following similar trends in sector preference with financial services, agriculture and energy.

- Across the regions, tech-based enterprises focused on solving challenges in the financial services, agriculture, energy and healthcare challenges have received the highest focus from social investors.

- Large pools of social investment capital deployed by African diaspora communities, faith-based organisations and other local capital providers represent a significant opportunity for collaboration with other social investors to make progress in key social sectors such as health care, education and affordable housing.

- The supply of social investment capital in the SSA region remains significantly mismatched with demand from social enterprises and impact businesses.

- With declining funding from donors and international foundations, non-profits are exploring alternative and more sustainable funding models.

The study includes an in-depth report for each of the three regions - East, West, and Southern Africa to provide detailed regional analyses.

“The East Africa section of this report shows there is an urgent need to diversify both the sources and the recipients of impact funds.

Development finance institutions are still among the largest providers of such capital, and most of these funds are invested in mature stage sustainable businesses that can absorb large amounts of capital.

Yet, to realise real change we need to see large capital flows from other sources such as the capital markets, high-net-worth individuals and grantors amalgamate in support of SMEs—the backbone of our economies.” says Nancy Kairo, AVPA Executive Director for the East Africa region.

AVPA plans to repeat this study every 2-3 years to track trends and improve the knowledge base within the ecosystem.