Unleashing the potential of nature finance: a pathway to mitigate risks and unlock benefits

The loss of wildlife has rapidly accelerated and has reached a staggering 69% decline on average since 1970, according to World Wild Fund's latest Living Planet Report, which we could assume is an issue for environmentalists to deal with.

However, nature provides all kinds of ecosystem services that businesses leverage, directly or indirectly, and according to KPMG, more than half the world’s economic output depends on nature, and its contribution is estimated at more than $125 trillion USD annually.

“Businesses rely on nature for products and suitable operating conditions. If these services are lost, it will affect business profitability and viability,” says Gillian Power, Director of Communications and Marketing at the International Sustainable Finance Centre of Excellence (ISFCOE), also referred to as the Centre.

She adds:

“While the economic value extracted from nature has continued to grow, such as crop production, many of nature’s other contributions to people are in decline, like soil productivity or pollinator abundance.”

The Centre first released its scoping study, ‘Nature and biodiversity finance: Risks and opportunities for Ireland’ in 2022 to examine the biodiversity agenda and highlight nature-related risks and potential impacts on various sectors, such as agriculture, real estate, and manufacturing.

Gillian explains that “the financial sector drives nature loss through the activities it lends to, insures, and invests in and is also exposed to financial risks from short- and long-term nature loss.”

To put this in perspective, she shares an example of the greenhouse gas emissions induced by Canadian banks' investments and loans to fossil fuel companies being 100 times higher than the operational emissions from the banks themselves.

She underscores that the finance sector, with its pivotal role in directing capital flows, has the power to steer away from detrimental practices and towards more sustainable investments, thereby contributing to net-zero goals.

“Banks have allocated over $2.6 trillion to sectors predominantly accountable for biodiversity loss, with many lacking sufficient processes or policies to monitor or mitigate these impacts and their exposure to nature-related risks. Similarly, globally, publicly funded development banks are estimated to finance approximately $800 billion in harmful activities annually.”

Based on their first study, ISFCOE realised that more detailed research covering the full spectrum of biodiversity-related risks and opportunities for the Irish financial system was needed, which led them to publish the Nature of Finance report in 2023.

KPMG Sustainable Futures and ISFCOE co-authored the report with support from Skillnet Ireland to establish a baseline in this area, raise awareness of the sector's interactions with and reliance on nature, and ignite deeper investigations.

This first-of-its-kind landmark study found that more than half (58%) of Irish lending goes to economic sectors with a high dependency on biodiversity and nature, while 94% (€85 billion) of lending goes to industries that potentially have a high impact on nature.

It also showed a clear link between bank lending in Ireland and economic sectors highly dependent on ecosystem services and impact nature in areas like managing surface and groundwater, climate regulation, flood and storm protection, erosion control, and pollination.

In addition, it recognises that Ireland hosts one of the largest insurance services sectors in Europe, which could open up new opportunities.

“The insurance industry in Ireland is a key agent of change in the move towards a more sustainable economy and society.”

She adds: “Transitioning to a carbon-neutral economic model requires long-term financing, and insurers are amongst the most significant institutional investors.

Many insurers have started to screen their investments using ESG criteria and increase their sustainable investment commitments.

As a result, they have become significant investors in green, social, and sustainable financial instruments.”

Based on her experience, Gillian believes that insurers and reinsurers increasingly acknowledge the imperative of addressing nature-related risks within their risk management and underwriting frameworks.

“Loss of biodiversity and degradation of nature pose risks for the financial sector, including physical risk due to increased frequency and severity of natural disasters such as floods, droughts, and storms, leading to infrastructure damage and disrupted supply chains.

You will also need to manage market risk, which means consumers are shifting preferences towards environmentally sustainable products and services.

Besides, businesses operating in sectors dependent on natural resources may face increased credit risks due to their vulnerability to environmental shocks and regulatory changes.

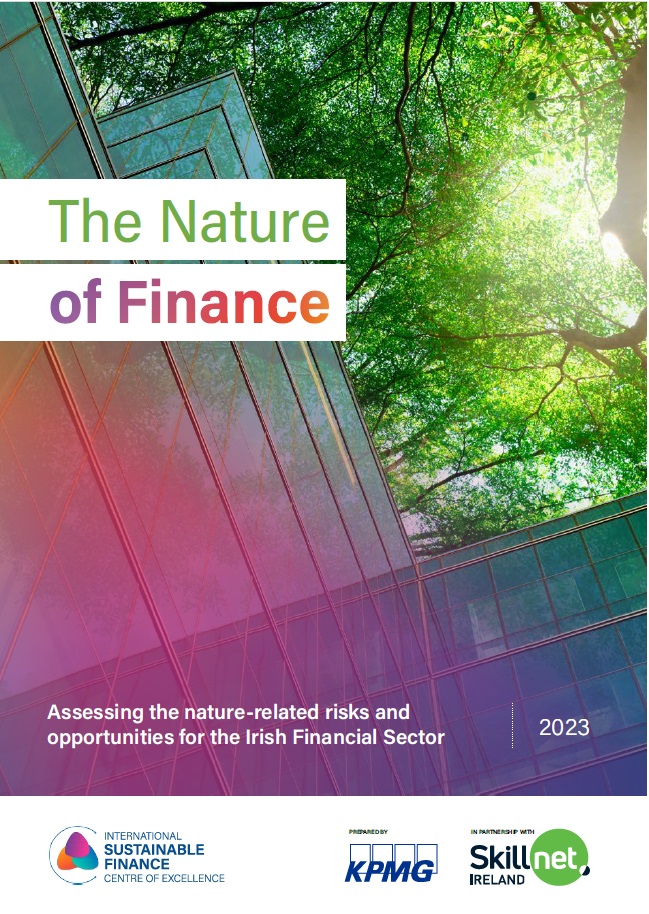

Given the scale and complexity of nature-related financial impacts, risks, and opportunities and how underdeveloped this area is, the report proposed a draft Nature Finance Roadmap to position Ireland as a leader on the nature finance agenda.

This Roadmap mirrors Ireland's Sustainable Finance Roadmap introduced in 2021 and is structured around its five main pillars: developing talent, improving industry readiness, leveraging digital and data, creating a nature-positive enabling environment, and enhancing communications and engagements on nature and finance risks and opportunities.

It also recommends establishing a Nature Finance Roadmap Delivery Group as an additional Pillar 0, including experts and stakeholders from public, private, and academic institutions.

Gillian further explains that the public sector is currently the more prominent actor in nature-based and biodiversity finance, offering financial instruments that would encourage businesses to advance conservation outcomes through tax breaks and other incentives.

She points out that the State also has a critical role in attracting foreign direct investment as capability and critical mass of expertise emerges.

“Our ongoing research in the nature and biodiversity finance space has presented us with a unique set of opportunities for both private and public sector financial actors and businesses in Ireland.

We are also advancing efforts in the space through ‘Communities of Practice’ discussions and by working on developing an upcoming course for finance professionals on Biodiversity Finance.”