Alarming global decline in investing in impact businesses

Data concerning a significant global slowdown in venture capital funding in startups primarily working on climate tech, renewable energy, circular economy, and social justice projects has been revealed in the Impact Startups 2023 report presented at the international ImpactFest event in the Netherlands.

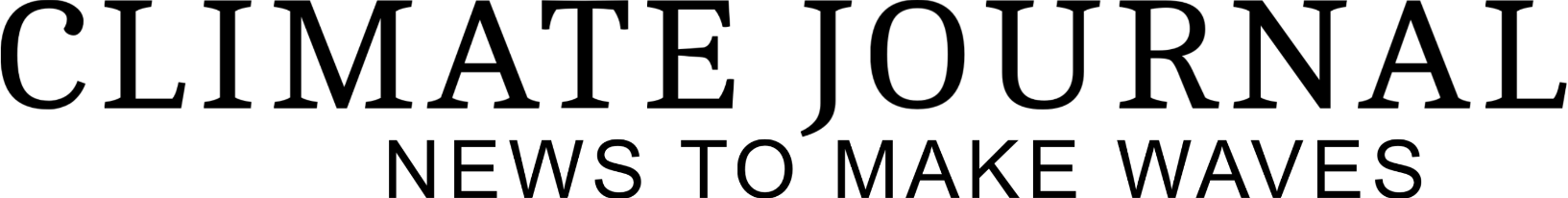

The research published in November by ImpactCity and Dealroom.co predicts about a one-third drop in investing in impact startups that are addressing one or more UN Sustainable Development Goals (SDGs) globally compared to 2022 levels, with over $41 billion in funds raised in 2023, so far.

"The impact investment landscape is suffering from the increased interest rates and global economic slowdown. Impact funding has decreased in line with the rest of the market, so looking narrowly at this year, we are not seeing it outperforming other investment themes,”

says Lorenzo Chiavarini, Venture Capital Research Lead & Impact Specialist at Dealroom.co.

These findings also feed into the worrying development that none of the 17 UN SDGs are on track to be achieved by the original deadline in 2030, which will also be discussed at the upcoming COP28, the UN Climate Change Conference in November in Dubai.

However, Chiavarini highlights that “zooming out in the last ten years, impact funding has grown 12x, more than twice the rest of the market”, saying that they “are confident Impact will start outperforming the rest of tech again in the coming years".

Despite the heavy decline, climate tech and affordable energy companies have been found to be at the forefront of unlocking investment while solutions addressing social challenges are least funded, according to this recent study that analysed the database of 17,000 impact startups.

One of the alarming trends showcased was the dramatic drop in funding for circular economy startups in fashion from its peak in 2021 at $1.8 billion to $140.8 million in 2023 at this point, despite the enormous environmental impact of the fashion industry.

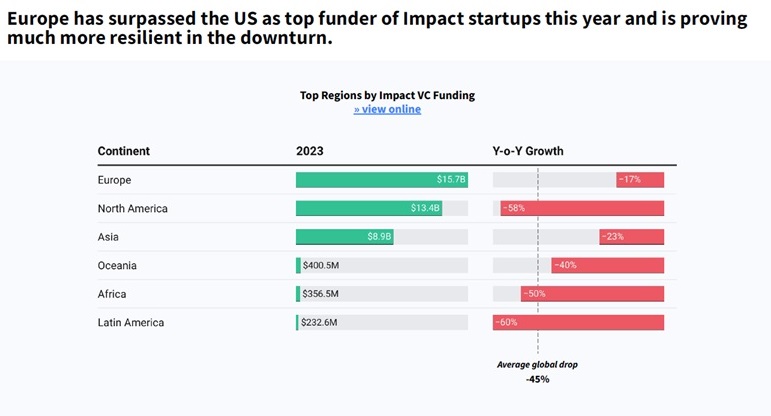

The research found that Europe is leaving the US behind in becoming the leading impact investing destination while proving to be more resilient in the downturn, with the Netherlands` over-index on impact on top of the ratings compared to the European average.

"It's stunning to see Europe becoming the top destination for venture capital impact investments for the first time ever. Europe has always been more impact-oriented than other regions like North America and Asia, now attracting nearly $15B of impact VC funding,"

Chiavarini adds.

Numbers also revealed that low and middle-income countries are lagging behind in attracting impact investments, securing only a minimal 5 per cent share of global impact funding even though they are most vulnerable to climate change impact and hosting over 50% of the global population.

Despite the report, the leading European annual impact event, ImpactFest, has sustained its popularity since 2016 among investors and startups, combining 'doing good and doing business', presenting solutions, and learning and networking opportunities to shake up the investment landscape.

ImpactFest is hosted by ImpactCity, an ecosystem builder supporting the development of impact companies. The event is traditionally held at the Fokker Terminal in collaboration with the Municipality of The Hague, Unknown Group, and KplusV and empowered by various partners, including Rabobank and B Lab.

Headline Image: Unsplash